The Government is working on a number of landmark reforms in the areas of retirement and pensions.

While some remain in the planning stage like the proposed automatic enrolment scheme scheduled to be implemented before the end of 2024 and proposals for legislation that would prohibit mandatory retirement ages that are lower than the State pension age of 66.

A new flexible pension model has been available to Employees since the 1st January 2024. Under this revised State pension model, Employees have the option to continue working until any age between 67 and 70. Employees can continue to drawdown the State pension at the age of 66 in the normal way but those that choose to defer their drawdown date will receive an ‘age referenced rate of State pension’ or an actuarially increased rate of payment.

Employees with sufficient PRSI contributions would be eligible for the following maximum actuarially increased rate of payment depending on their age of retirement:

| Age on claim start date | 66 | 67 | 68 | 69 | 70 |

| Maximum Rate | €277.30 | €290.30 | €304.80 | €320.30 | €337.20 |

What does this mean for Employers?

While the extra options are likely to be welcomed by Employees, they may trigger workforce planning challenges for Employers.

The new State pension model will likely incentivise certain Employees to continue working beyond an established contractual retirement age. Employees who do not have the requisite level of PRSI contributions to be eligible for the maximum rate of payment under the State Contributory Pension may seek to defer their retirement date to make up any shortfall in Employee PRSI contributions. Other Employees may not have made sufficient provision for their retirement and may seek to continue working longer to avail of the increased rate of payment under the new flexible State pension model.

If this trend emerges in Irish workplaces, Employers will be dealing with more requests to continue working beyond an established contractual retirement age as well as the associated workforce planning challenges that this entails.

Growing age discrimination risks

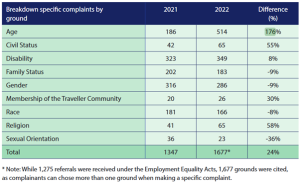

The CSO’s 2022 Census revealed that the proportion of the population aged 65 years or over increased from 12 percent in 2012 to 15.1 percent in 2022. With the Irish workforce ageing, it is perhaps no surprise that the Workplace Relations Commission is being asked to resolve more and more age discrimination claims. Reviewing the 2022 Workplace Relations Commission’s Annual Report, it appears there is a stark increase in age-related discrimination complaints with an increase of 176% since the 2021 report figures. A large majority of these claims are made by Employees who contest the validity of a contractual mandatory retirement age.

Increasing challenge of enforcing mandatory retirement ages

A mandatory retirement age is prima facie discriminatory but a contractual mandatory retirement age is permitted under the Employment Equality Act so long as it can be objectively and reasonably justified by a legitimate aim and the means of achieving that aim are appropriate and necessary.

The Workplace Relations Commission’s Code of Practice on Longer Working sets out a number of legitimate aims that will justify a mandatory retirement age including:

- Intergenerational fairness (allowing younger workers to progress);

- Motivation and dynamism through the increased prospect of promotion;

- Health and Safety (generally in more safety critical occupations);

- Creation of a balanced age structure in the workforce;

- Personal and professional dignity (avoiding capability issues with older employees); or

- Succession planning.

While the aim of the mandatory retirement policy may be legitimate, Employers should also be prepared to provide evidence that mandatory retirement is an appropriate and necessary means of achieving that aim.

Individual assessment of requests to continue working

A recent decision in the Workplace Relations Commission emphasises the importance of making an individual assessment of Employee requests to continue working.

The Employee in question successfully made a prima facie case of discrimination on the ground of age when forced to retire at age 65 in line with the Organisation’s mandatory retirement policy. The Employer failed to rebut the presumption of discrimination largely because it failed to make an individual assessment of the Employee’s circumstances and his request to continue working.

Employers should therefore consider each application to continue working beyond a contractual retirement age on its own merits and carefully follow the procedures and guidelines in the WRC’s Code of Practice on Longer Working.

Changing statutory and legal framework

The Code of Practice on Longer Working recommends that Employers consider the changing statutory and legal framework regarding retirement and pension entitlements.

With pension reforms set to continue this year, it is a good time to review retirement policies and to ensure that managers are prepared for conversations with Employees who want to continue working beyond a contractual retirement age.

Don’t let retirement-related HR issues hold your business back. We understand the challenges of changing Employer legislation and have helped hundreds of businesses across Ireland with key Employment matters such as retirement. Partner with Adare Human Resource Management for advice, support, and guidance from our trusted HR experts.

Contact us today to learn more about how we can help your business prepare for the shifting landscape of retirement.

Adare – info@adarehrm.ie / 01 561 3594 to discuss how we can assist your Organisation.

Stay informed, stay compliant, and lead the way in promoting workplace equality.